Content

You’ll have to speak to your most other bank to understand the transfer and you can detachment constraints (they are the limits one to restriction how much money you can be transfer anywhere between membership on the any given day). Understand that you only pokiespins casino have 10 diary weeks away from the fresh time your account are unsealed to transfer fund into your the new Judo Bank on line Identity Put. Since the a home thought and probate attorney, Roberson deters clients out of storage space the brand-new house thought data inside the a secure put box. Whether or not this individual is given the key and you may passcode, of several financial institutions tend to nevertheless deny access if the name’s maybe not for the safe deposit package book while the a mutual renter, she warns. The brand new Government Deposit Insurance policies Corporation (FDIC) talks of a safe deposit field while the a good “storage space provided by the lending company.” Therefore, one content material to the aren’t insured from the regulators service if damaged otherwise taken.

If you need the money urgently, this really is worth noting as you may must see an option choice. Most banking companies allow you to include money on the savings account each time. For identity deposits, extra dumps essentially are not welcome in the label. For individuals who withdraw finance before the readiness day, you could incur fees and you will a decrease in the interest earned.

Pokiespins casino – Score speed notification

When it comes to article workplaces, the new charges believe the term of one’s FD. When you yourself have open your repaired put having an NBFC, up coming, for each RBI guidance, you will find a minimum secure-within the age 90 days. If you decide to withdraw between 3 and you can half a year, please note you to definitely just the principal matter try returned, and you may earn no interest earnings. When the withdrawn just after half a year, their interest income is actually computed at a level of dos% below the brand new applicable interest rate. Guess you’ve got invested in a fixed deposit plan for example seasons for a price out of 6% per annum. Let’s along with assume that their financial have an insurance policy out of deducting 1% to the early distributions.

Repaired Deposit (FD) foibles inside India

Closing the new Computer game through to the term finishes lets the consumer take straight back the main amount spent, however with the fresh forfeiture of the gained focus. People not merely discovered increased rates to have locking right up its currency on the financial for extended attacks, and also earn a high rate to have highest deposits. Including, a jumbo Computer game, that is an expression deposit over $a hundred,100, will get a high rate of interest than simply a $step 1,000 Cd. Whenever rates drop off, people are encouraged to borrow and you can spend more, and so stimulating the fresh discount.

TDS try subtracted each and every time the financial institution pays/re-invests focus inside the Financial season.At the same time TDS is additionally subtracted to your interest accrued(yet not yet , paid back) at the conclusion of monetary 12 months viz. If the change otherwise improvement in your put collection earns a great collective attention as well as that the sooner profile greater than Rs. Rs. fifty,000/- (Rs. 1,00,100 to own seniors) in the a monetary year, you might be responsible for TDS on the current collection.

- When you’ve accomplished the requirements, your bonus would be transferred in this 15 days.

- The Indian owners, along with elderly people and you will Non-Resident Indians (NRIs), can be unlock an FD account.

- The brand new Treacys aren’t alone inside studying stunning areas of safe deposit packets.

- Following that, you could potentially transfer finance to the selected account on the web because of the clicking ‘Transfer money’.

Defending your own things is a crucial responsibility, and you will knowing the fate of safety-deposit boxes inside lender failures is an important step to the guaranteeing their protection. To have rollover alternatives (choices an excellent and you will b in the list above), you might want to amend the term you are reinvesting to own. Keep in mind the fresh relevant interest rate could be the prevailing interest on the readiness time, which may be less interest rate than one to relevant in order to your previous label deposit. You can not increase the amount of fund for your requirements when your Label Deposit might have been fixed. If you attempt and make subsequent deposits after that time, such repayments won’t be canned and you can fund would be came back so you can in which they originated. You’ve got the prospective that your safe-deposit package might get broken for the through the a financial burglary.

When you are efficiency on the TDs tend to be lower than riskier opportunities, it can be a guaranteed solution to grow your currency. Let’s say which associate private decides to liquidate what you that they have, and set almost everything completely on the a phrase put to call home from the desire. This is why far they might earn, this time around having fun with Judo, which supplies a few of the high costs in australia as per Deals.com.au’s general market trends.

If we enable it to be an early withdrawal, we’ll slow down the desire payable to your money you withdraw (your get back does not wade less than 0%). When you’re financial institutions have traditionally offered a secure ecosystem for these boxes, the possibility of financial failures necessitates a proactive approach. To incorporate specific amount of protection to possess safety-deposit package owners, of several jurisdictions features particular laws in place. This is a significant potential disadvantage of employing a deposit field during the lender.

Once you’ve determined exactly what provides are essential for your requirements, beginning a bank account on the web and no cash is as basic as the applying. It is possible to prefer whether or not you want a bank checking account, bank account, or certain consolidation. A bank account assists you to invest your finances easily, when you’re a family savings might be a great or even wish to access the money frequently. He opened a big, marble strengthening in the down Manhattan, filled with a dense material vault.

How to get Pursue extra rather than lead put?

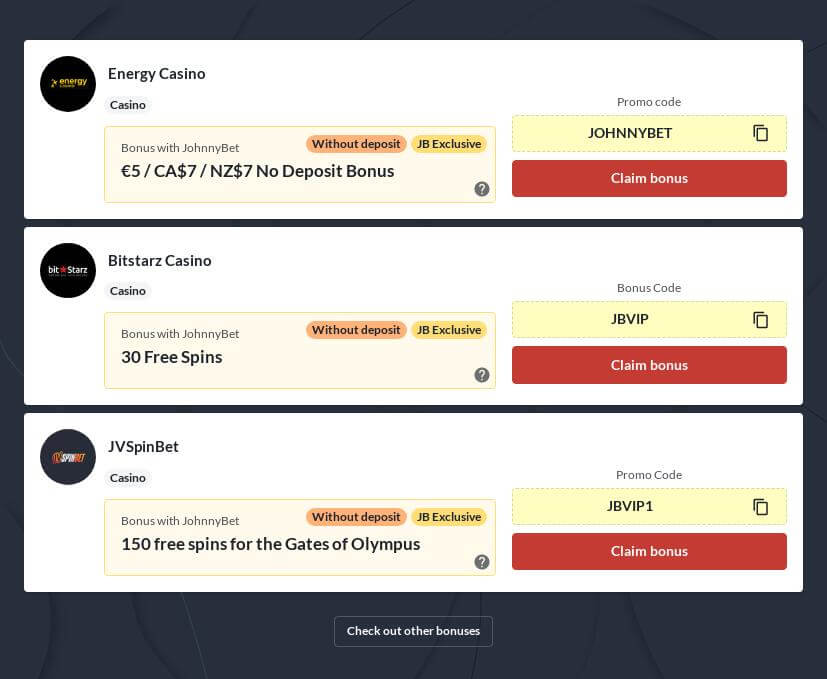

Ed Craven and Bijan Tehrani is actually available to your public systems, and you will Ed can be real time-online streaming for the Kick, enabling viewers to ask alive concerns. This can be somewhat rare from the crypto local casino industry, as numerous residents cover up its actual identities having fun with on the internet pseudonyms otherwise business formations. Since the Split The newest Piggy-bank exists round the of a lot on the web gambling enterprises it’s vital that you decide the big website to own a great time. Compared to the video game that have inconsistent RTPs around the gambling enterprises Break The brand new Piggy Financial assurances uniform RTP beliefs in order to focus on going for an educated local casino for your feel. A handful of an educated gambling enterprises i highly recommend to have trying out Crack The newest Piggy bank ability BC Games Gambling establishment, Bitstarz Gambling establishment, 22Bet Gambling establishment. These are all the casinos on the internet that people feel comfortable suggesting and you will you to discover excellent recommendations within ratings.

Business

When you are a senior, everything you need to manage is actually check in in general by the contacting people Branch which have proof their Date of Delivery. After inserted because the a senior citizen, you’re qualified to receive preferential rates of interest to your Repaired Deposits open due to NetBanking also. We frequently remove currency for example a hurry — chasing after production, record trend, contrasting which’s getting more as to what. Yes, you might prepay the brand new borrowed amount when instead incurring prepayment fees most of the time. Yes, certain banks might need the fresh FD for at least kept period in order to qualify for an enthusiastic OD. Once you have made additional money, check out Ray and make the remainder three bits of business your.

If you would like crack your identity deposit, the first thing should be to browse the terms and conditions together with your financial otherwise vendor. This should definition precisely what the merchant’s process are, and you can what sort of charges you may be against. If you have receive your self inside the sudden need of finance, however your greatest nest-egg is actually locked aside within the a phrase deposit, you happen to be in a position to break your name put and you may accessibility the deals. After you achieve the end of one’s label, you have the choice to immediately “roll-over” your own deposit for another term, or to withdraw or transfer the money to some other account (as well as another label deposit). Name dumps works because of the agreeing to put a sum of money which have a financial or some other Authorised Put-getting Institution (ADI) for a predetermined amount of time.

The newest fund’s authored, amortized really worth may well not exceed forex trading worth by the over 1/dos cent for each express, an evaluation which is generally made a week. If your variance does surpass $0.005 for each show, the newest money will be considered to features damaged the fresh buck, and you will regulators will get push they to the liquidation. All the details provided with Deals.com.bien au is actually general in general and will not be the cause of your objectives, financial predicament, or needs.